This is the view of Bioenergy Europe, which in early 2025 released its Bioenergy Landscape Report 2024, a detailed analysis of the role of bioenergy in supporting Europe’s transition to a net-zero emissions economy by 2050. The report delivers important insights for decision-makers and market participants and highlights bioenergy’s contribution to reducing climate impact, increasing energy security and economic competitiveness.

Source: Bioenergy

The 2024 Landscape Report provides clear and useful data to understand the role of bioenergy in Europe’s work to reduce climate impact, says Jean-Marc Jossart, Secretary General of Bioenergy Europe, and continues:

Bioenergy is still the largest renewable energy source in Europe today and offers unprecedented opportunities to reduce emissions, create jobs and strengthen energy security by using local resources.

Engine of growth and innovation

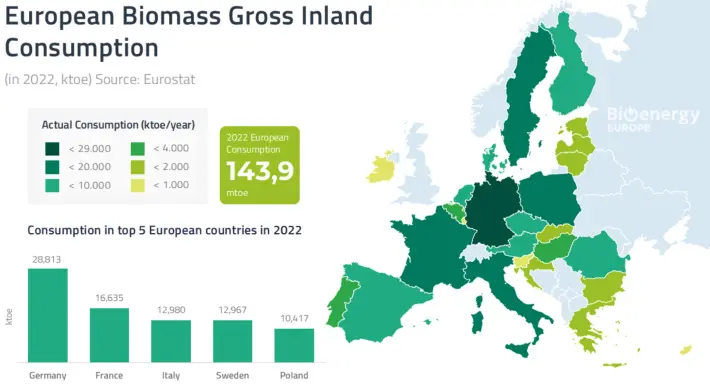

The report shows that bioenergy accounted for 54 percent of Europe’s renewable energy mix in 2022, avoiding 300 million tonnes of fossil carbon dioxide emissions annually. The sector contributes directly to Europe’s energy security by reducing its dependence on energy imports while boosting rural economies and providing local jobs.

“Europe has a unique opportunity to lead the way in renewable technologies, creating 1.5 million jobs and potentially increasing EU GDP by up to €70 billion by 2050. It is time to put bioenergy at the heart of Europe’s energy, industrial and climate strategies,” adds Jossart.

Bioenergy Europe’s recommendations:

Bioenergy Europe identifies four critical areas where bioenergy can deliver immediate and long-term benefits to the EU’s climate and energy goals and unlock the full potential of bioenergy as a cornerstone of a net-zero economy:

1. Stimulate bio-based carbon capture technologies

The EU should encourage bio-based carbon capture technologies such as BECCS (Bioenergy with Carbon Capture and Storage) to achieve European low-carbon targets and support the industrial transition from a fossil-based to a bio-based economy.

2. Accelerate the upgrade of sustainable heating equipment

Modern bio-heating equipment offers a cost-effective solution to reduce fossil emissions in the EU’s heating sector. Replacing older equipment with modern solutions will improve energy efficiency, reduce emissions and lower costs for both households and businesses.

3. Secure a sustainable supply of biomass

A secure and sustainable supply of biomass will strengthen Europe’s bio-economy and support its energy and climate goals. The bioeconomy strategy should reflect this.

4. Ensuring stable regulatory frameworks

Stable regulatory frameworks are crucial to attracting investment and fostering innovation. This is important to increase the EU’s competitiveness and drive the transition to a net-zero economy.

Source: Bioenergy (Swedish)